Contact Us

Phone

+44 (0)1548 857009

Address

Britton House, Fore Street, Kingsbridge, Devon. TQ7 1NY

info@southwestfx.co.uk

Did exporters react quick enough to protect themselves from a stronger pound?

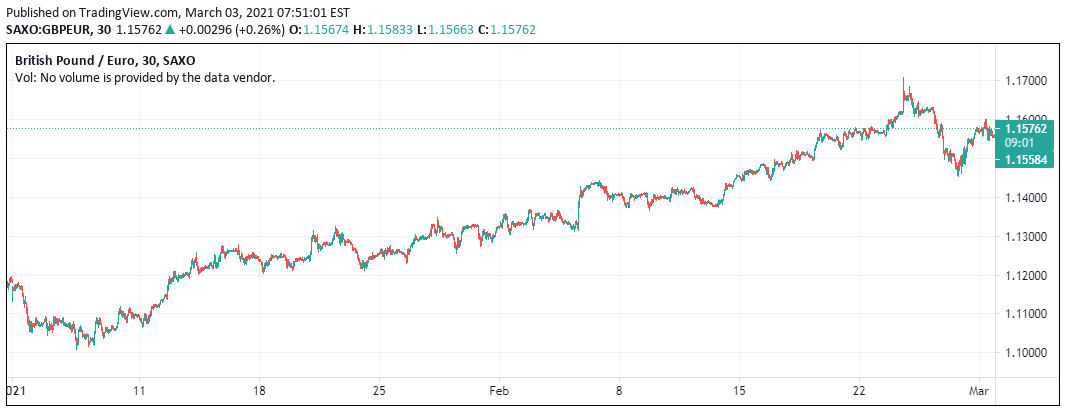

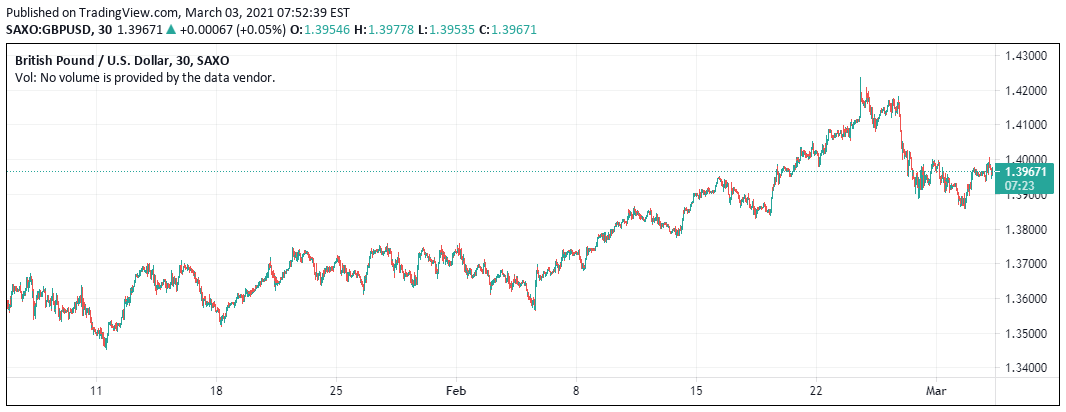

Ever since the welcoming news that a Brexit deal was agreed in December, we have seen, as you can see below, that the pound has risen in value against the euro and the dollar. We have seen movements on the euro from 1.1050 to 1.1706 a rise of 5.94% and on the US dollar from 1.3550 to 1.4235 equating to 5.05%.

This has been a welcome revaluation of the pound against both currencies, as several analysists have said that the pound has been undervalued for a while and it is slowly moving back to where it should be. These exchange rates we have not seen for many months, to be exact since the 16 April 2018 on the USD and 20 Feb 2020 on the Euro. There is a lot to be said for a strong currency. If we were allowed to travel abroad, our spending money would go further. A stronger currency usually reflects a stronger economy and a better outlook compared with peers. How long might it take for the rest of Europe catch up and are we going to see a rebound.

However, with vaccine mania running through the veins of the UK, there is talk throughout Europe that this rise in the value of the pound is short lived and this constant growth will slow down; they were proved right. We have certainly seen both currencies come off their highs for the two-month period, so will we see these currencies stabilise for, at least a while, at these levels until the rest of Europe catches up with the UK’s very successful vaccine programme.

What can we expect in the future? This weeks’ budget didn’t really come up with too many surprises and thus the market has been very subdued. What has your experience been during these first two months? What help and guidance have you been getting from your bank or currency provider to help you through this period?

As exporters, did you sell currency before the pound rose in value? As you will be aware, as the pound rises, the value of the goods that are bought for dollars, euros or any other currency, are worth less when translated back into sterling, which can have a serious effect on your profit margins.

We have seen a lot of exporters cautiously watching the market and hedging themselves against the pound getting any stronger. Have you done this already or do you need some help to see what your options are?

Once again, not protecting your foreign income from a more expensive pound is always going to reflect on your bottom line. We can provide very simple and effective ways for losses to be nullified.

We come across many businesses that would benefit from the type of guidance and currency services we can offer. We could save them thousands of pounds in exchange rates and help them to handle, on a daily basis, their currency exposure and for a much more competitive price than their banks charge. Where most of the time their banks are offering no help or information at all, we offer a full treasury function for those working in the international marketplace and have the need to exchange foreign funds.

We ask ourselves every day, why aren’t these companies accepting our offers for help? We know we can make a difference to their bottom line almost immediately and can work with them to form a long-term strategy to negate currency risk.

Don't waste any more time and money, give SW Foreign Exchange a call today and see what we can do for you and your business. We operate unlike any other company who profess to do the same as us. We are set up primarily to put our clients first and to make a real difference.

About

South West Foreign Exchange Ltd is an independent specialist foreign currency consultancy giving guidance and help to corporates and private individuals with regards to their foreign exchange transactions, we offer a local South West based service with global execution.

Information

Contact Us

Address

Britton House, Fore Street

Kingsbridge, Devon

TQ7 1NY

Phone

+44 (0)1548 857009